A hot summer hasn’t been nearly enough to offset the surplus of natural gas that has accumulated over the past two warm winters in the U.S. Absent a cold winter, signs are pointing to another season of misery for producers.

Front-month Henry Hub prices have averaged $2.19 per million British thermal units so far this year, the lowest average through this time of year since the pandemic demand-shock seen in 2020. Spot prices for August were the lowest they have been since 1998, according to the Energy Information Administration.

“The market really has been under a deluge of supply for the entirety of 2024,” said Eli Rubin , energy analyst at EBW Analytics.

It started last winter, when U.S. natural-gas production surged to record levels despite already-full storage. Unusually warm temperatures led to demand that wasn’t nearly robust enough to work through the excess natural gas.

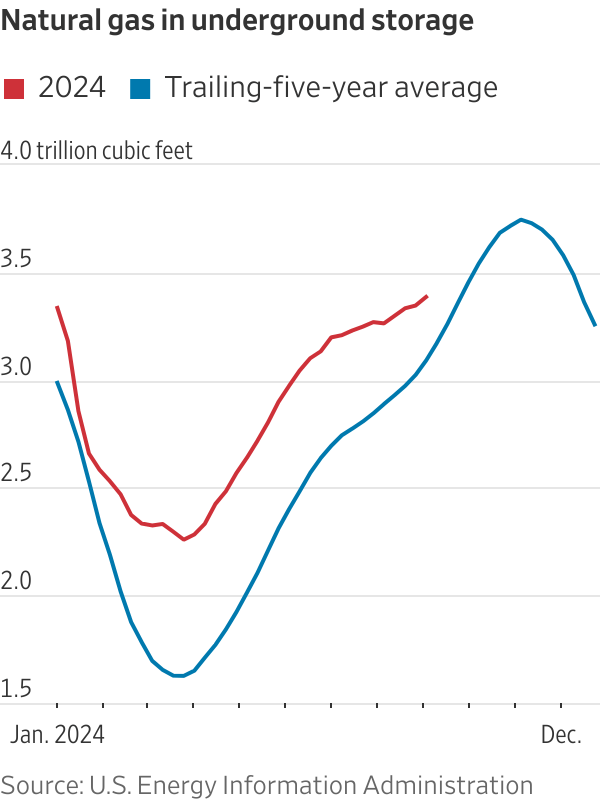

By the time spring arrived, there was about 40% more natural gas in storage than the trailing-five-year average. While that gap has narrowed, natural-gas inventories still remain about 9.6% higher than the five-year average, according to a report from the U.S. Energy Information Administration on Thursday.

Drillers have cut back on natural-gas production but not enough to completely work through the surplus. S&P Global Commodity Insights estimates that U.S. natural-gas production from April through October will average 101.7 billion cubic feet a day this year, 1 bcf/d lower than a year earlier.

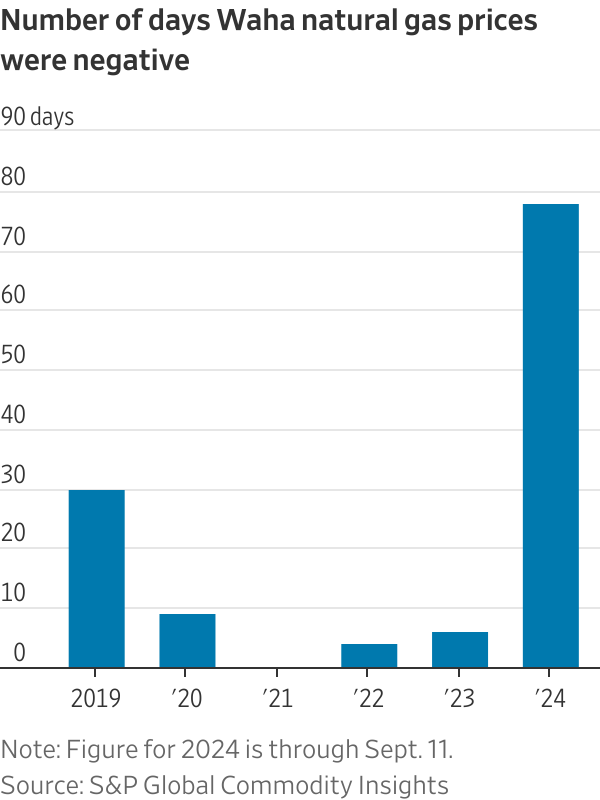

Oil prices have been high enough that producers in the Permian Basin keep pumping oil out of the ground, and natural gas along with it. These producers are willing to pay someone to take natural gas off their hands.

Natural-gas pricing at the Waha hub near the Permian Basin has been negative for more days this year than any other year that S&P Global Commodity Insights has tracked that pricing, according to Matthew Palmer , North American natural-gas analyst for the data provider. On top of that, Canada has also been swimming in surplus natural gas and sending more of it to the U.S.

This summer’s heat did help boost natural-gas-fired electricity demand, especially because cheap prices encouraged more switching from coal. What didn’t help was Hurricane Beryl, which in July shut down liquefied-natural-gas export capacity at Freeport LNG for about two weeks, trapping some of that overseas-bound natural gas. Demand for natural gas by LNG facilities is barely expected to rise this year, according to S&P Global Commodity Insights.

Natural-gas prices might stay under pressure for a while longer. For one, a major pipeline, Matterhorn, that will carry natural gas away from the Permian Basin is expected to start up before year-end. This will help relieve the regional glut but add supply to other regions.

Additionally, the gap between natural-gas prices for October delivery and those for December delivery has been very high—the gap is about 73 cents per MMBtu—giving producers an incentive to hold off on production today and sell contracts promising delivery in the winter, according to Rubin. That price gap could encourage a surge of production toward the end of the year, he said.

Absent a cold winter, the next boost to natural-gas demand likely won’t come until 2026, when meaningful LNG export capacity is expected to be added. Project delays have moved back the start date for some major projects, including Exxon Mobil and Qatar LNG’s Golden Pass. Further out in the future, prices could also rise if the bullish forecasts for electricity demand from data centers supporting artificial intelligence materialize.

All of that isn’t great for natural-gas producers, but it could be a nice reprieve for heating bills this winter.

Write to Jinjoo Lee at jinjoo.lee@wsj.com