Moscow is working on a plan to merge its biggest oil companies into a single national champion, a deal that would tighten President Vladimir Putin ’s grip on global energy markets and Russia’s wartime economy.

Under one scenario being discussed, state-backed giant Rosneft Oil would absorb fellow state producer Gazprom Neft—a subsidiary of natural-gas exporter Gazprom—and independently-owned Lukoil, people familiar with the discussions said. All three are under U.S. sanctions.

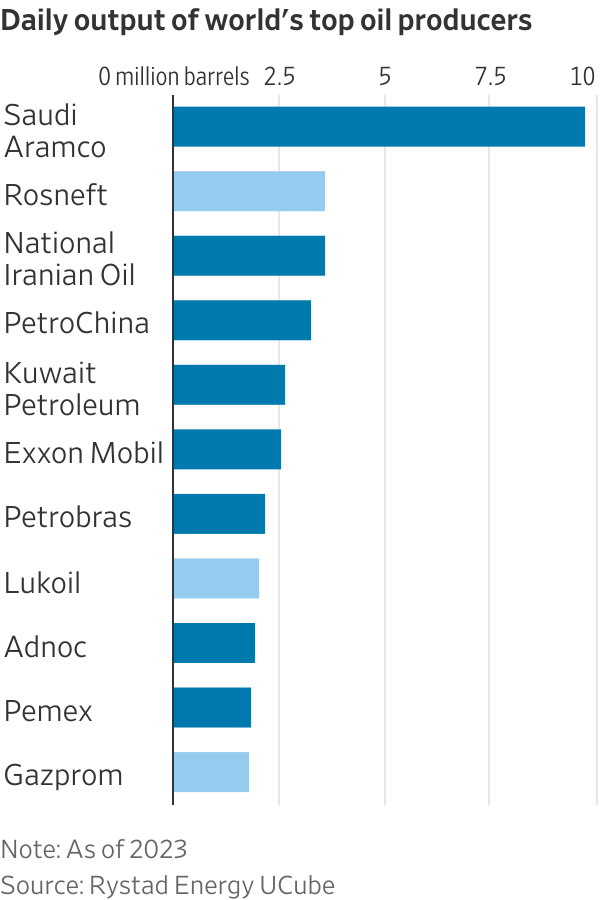

The resulting company would easily be the world’s second-biggest crude producer, after Saudi Arabia’s Aramco. Pumping almost three times the output of Exxon Mobil , the biggest American producer, a combined entity could enable Russia to wring higher prices from customers in places such as India and China.

Talks among executives and government officials have taken place over the past few months. They may or may not result in a deal, and details of any plan could change, the people said.

Speculation about mergers and takeovers periodically sweeps Moscow and St. Petersburg but no big energy deals have transpired in the past decade. Obstacles include opposition from some Rosneft and Lukoil executives as well as the challenge of amassing the funds to pay Lukoil shareholders, some of the people said.

A Kremlin spokesperson said the administration had no knowledge of a deal.

A Rosneft spokesman said that The Wall Street Journal’s reporting was false, based on information available to him. He said in an email that the Journal’s article “may be aimed at creating competitive market advantages in the interests of other market participants.” Asked by phone what information Rosneft considered to be inaccurate, the spokesman said he wasn’t allowed to answer questions.

A Lukoil spokesman said neither the company nor its shareholders were in the process of merger negotiations “with any parties as this would not be in the interest of the company.”

Spokesmen for Gazprom Neft and Gazprom didn’t respond to requests for comment.

The talks underline Putin’s desire to muster the energy sector to support his war effort, the people familiar with the talks said. The Russian president, some of them said, envisions a juggernaut able to compete with Saudi Arabia at a time when oil demand, while still enormous, is slowing in the face of greener alternatives.

Oil and gas are the lifeblood of Russia’s economy , supplying almost a third of federal revenue and handing Putin influence around the world. Russia’s success at stabilizing its economy in the face of Western sanctions is in large part thanks to its oil industry.

A champion exporter may be better able to withstand Western sanctions, which have complicated exports, hamstrung big new oil-and-gas projects and snarled payments , the people said. The talks, while influenced by the war in Ukraine, are also meant to prepare Russia for an eventual postwar thawing in economic relations.

Bringing Lukoil under direct state control would mark a big step toward fully unwinding the privatization of Russia’s mineral riches after the collapse of the Soviet Union.

When he came to power a quarter-century ago, Putin ruthlessly reorganized the fragmented post-Soviet oil industry, arresting oligarchs and redistributing power to his allies. Today’s handful of players maintain different levels of independence from the government, but all are seen as ultimately compliant to the Kremlin’s wishes. The leaders of the three oil giants are considered among the most powerful players in Putin’s orbit.

For Putin, a combination carries risks. The presence of oil company fiefs prevents any one boss from gaining too much clout. Russia’s oil companies cooperate as part of the OPEC+ cartel, but compete for market share and vie for favor with the government.

Supporters of the plan believe a combined company could make significantly more money, some of the people said. One reason: Oil from all three companies could be sold with the help of Lukoil’s big Dubai-based trading arm, Litasco.

Rosneft in particular has faced difficulties maximizing profits on its exports. Western sanctions allow Russia to sell oil, but seek to limit how much it earns and where the crude can go.

Since early in the war, Rosneft has relied on a secretive network of trading and shipping firms run by a little-known trader from Azerbaijan to send crude to buyers, the Journal reported this year. At times, this operation has struggled to extract payments from India and elsewhere, according to people familiar with its business and documents seen by the Journal.

As well as the trading unit, Lukoil has reserves in the Middle East, Africa, the Americas, and in Russia. One of Russia’s two remaining major independent producers, Lukoil also has a gas-station network, owns refineries in Eastern Europe and has a Moscow stock listing.

A week after the Ukraine invasion in 2022, Lukoil’s board called for an end to the fighting in an open letter to shareholders, customers and employees, making it a rare Russian company to have publicly opposed the war. Ravil Maganov , then chairman, died when he fell from a hospital window in Moscow six months later, state media reported at the time.

Longtime boss Vagit Alekperov —a former deputy Soviet energy minister, and Russia’s richest person last year, according to Forbes—officially resigned as Lukoil president in April 2022, days after being sanctioned by the U.K. He remains the biggest shareholder.

A deal would spark a shake-up in the Russian corridors of power. A main player in the talks is Rosneft boss Igor Sechin , a Putin confidant since the 1990s and former deputy prime minister.

Under Sechin, Rosneft expanded into a massive producer, partnered up with the likes of Exxon and received investments from BP and Qatar’s sovereign-wealth fund. All the while, the U.S. said when it sanctioned him in 2014, Sechin displayed “utter loyalty to Vladimir Putin.”

He has played a major role in foreign relations because of Rosneft’s strategic ties with foreign governments. His 35-year-old son died earlier this year .

It isn’t clear if Sechin would head any eventual combined company, some of the people familiar with the talks said. Another possible leader of the group could be Aleksandr Dyukov , who is credited by analysts with having introduced Russia’s most advanced oil-extraction technology as CEO of the smallest of the three producers, Gazprom Neft.

Write to Costas Paris at costas.paris@wsj.com , Joe Wallace at joe.wallace@wsj.com and Anna Hirtenstein at anna.hirtenstein@wsj.com