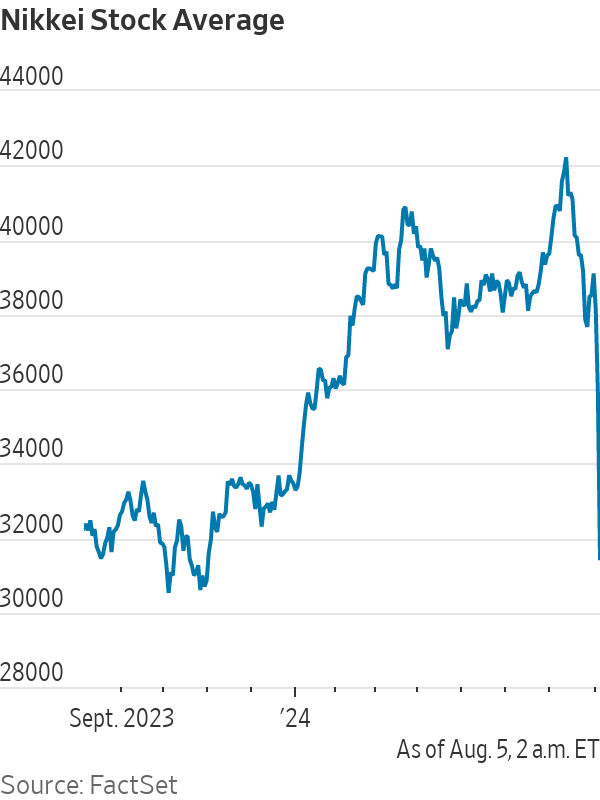

Japan’s Nikkei Stock Average closed down 12.4% on Monday, a historic fall triggered by disappointing U.S. jobs data and a further rise in the yen.

The index’s drop followed a 5.8% fall on Friday. The Nikkei has given up all its gains this year and has dropped more than 25% since it reached a record high last month, putting it in bear-market territory.

It was the biggest single-day percentage drop in the Nikkei since it fell 14.9% on Oct. 20, 1987, after the “Black Monday” crash on Wall Street.

Other stock indexes in Asia also fell, with South Korea’s benchmark Kospi down 8%.

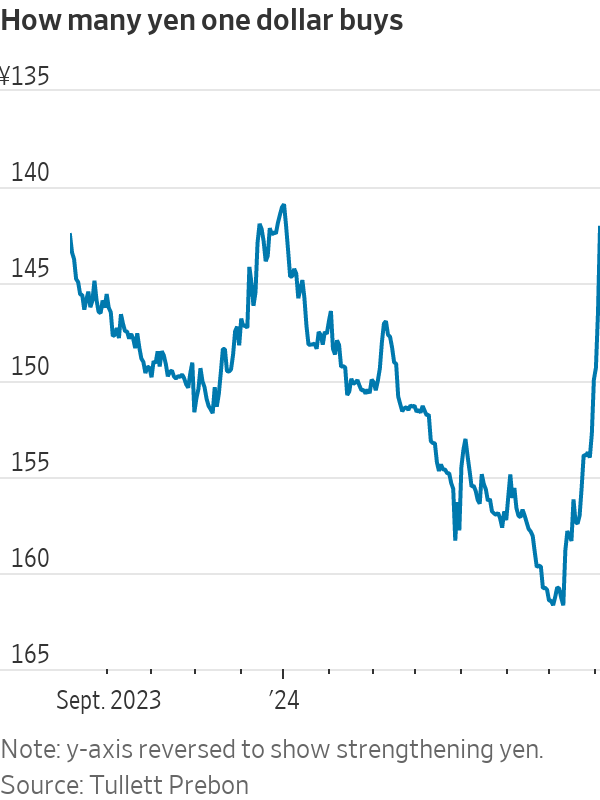

U.S. jobs growth slowed sharply in July and the unemployment rate rose to its highest level since 2021, the U.S. Labor Department reported Friday. The yen strengthened against the dollar as a result.

The interest-rate gap between the U.S. and Japan has started to narrow after the Bank of Japan raised its policy rate last week, and is likely to shrink further if the Federal Reserve starts cutting. That makes yen-based investments more attractive.

The yen was trading at around 142 to the dollar on Monday in Tokyo, compared with 148.95 as of Friday’s Tokyo stock-market close and about 161 in early July, which was its weakest level in 37 years.

Many analysts expect the Federal Reserve to cut rates at each of its three remaining meetings this year. A handful of economists said Friday that the Fed will need to move faster if it want to improve its odds of short-circuiting an economic downturn.

Financial and exporter stocks led the declines in Tokyo on Monday. Sumitomo Mitsui Financial Group was 16% lower.

In general, a strengthening yen tends to dent earnings for Japanese companies because it makes exports less competitive overseas and decreases the value of profits earned abroad in yen terms.

Earlier this year, the Japanese stock index soared to record highs, driven by stronger corporate earnings on the back of a weak yen, the return of modest inflation and improvements in corporate governance.

Write to Kosaku Narioka at kosaku.narioka@wsj.com