The Federal Reserve is set to cut borrowing costs at its two-day meeting that ends Wednesday. The goal: preserve a solid job market now that price pressures have cooled.

The decision over whether to cut the Fed’s benchmark interest rate, currently at a two-decade high between 5.25% and 5.5%, by either a larger half percentage point or by a traditional quarter point will come down to how Chair Jerome Powell leads his colleagues through a finely balanced set of considerations.

Economic data over the past several months show inflation has resumed a steady decline to the Fed’s 2% goal. But the labor market has cooled, with the unemployment rate edging up to 4.2% in August from 3.7% at the end of last year. Monthly payroll growth has slowed to 116,000, on average, for the three months through August, down from 212,000 in December 2023.

“The key issue for them at this meeting is their sense of the balance of risks,” said William English , a former senior Fed adviser. “If you are more worried now about growth and employment than inflation, then you might well want to take out a little bit of insurance” with a larger cut of a half point, or 50 basis points.

The argument for a smaller cut of a quarter point, or 25 basis points, rests on different considerations, including that the economy is fundamentally fine or that cutting too fast could stoke risk-taking that sustains higher inflation. “If they’re not convinced that inflation is really as good as the recent data has suggested, they may still be worried that the battle against inflation will be more protracted and uncomfortable,” said English, a professor at Yale School of Management.

English said a few weeks ago he thought a smaller cut would be appropriate. But the recent downtrend in labor-market data has him more nervous, particularly because even after two or three cuts, interest rates will still be at a relatively high level .

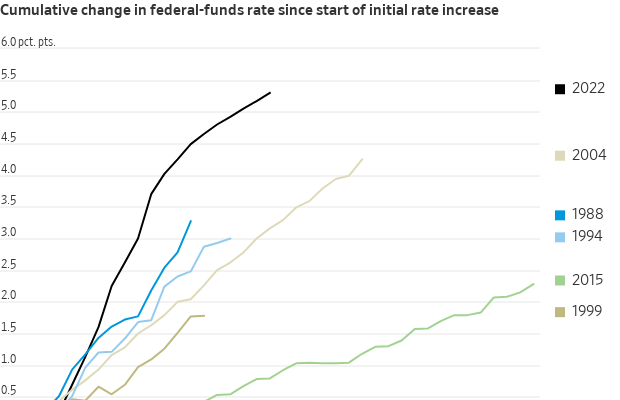

Fed officials have tended to raise or lower rates in increments of a quarter point to study the effects of those moves. But they move faster when they think their rate stance isn’t well aligned with the balance of risks. Officials hiked in 50- and 75-basis-point increments to fight high inflation in 2022.

Shifting expectations

Until late last week, investors had expected a cut of just a quarter point because few officials had made a vocal call for a larger cut. “Their communication said 25. The data was OK,” said Laurence Meyer , a former Fed governor.

With inflation still above the Fed’s target and given that the economy is “in generally good shape, you can start with 25 and say, ‘We can either keep this up for a while, or if it looks like things are weaker, we can go harder,’ ” said Esther George , who was president of the Kansas City Fed from 2011 to 2023.

Fed officials were noncommittal about the size of the cut on the eve of the central bank’s premeeting quiet period that began on Sept. 7. “I was a big advocate of front-loading rate hikes when inflation accelerated in 2022, and I will be an advocate of front-loading rate cuts if that is appropriate,” Fed governor Christopher Waller said on Sept. 6, after the release of the most recent payroll report.

During a question-and-answer session that followed, he sounded relatively unperturbed by the recent, slower pace of job growth. Even if monthly job growth declines to 100,000, “that’s fine,” he said. “That’s nothing to be afraid of.”

Speaking the same day, New York Fed President John Williams said recent data point to “a pretty common trend…. What we’re seeing is a consistent signal of cooling. We want the economy to be in balance and stay in balance.”

Regret management

Fed officials often refer to their job as risk management—for example, making sure that they weigh the risks of hotter inflation against the risks of accelerating unemployment. They often set rates to manage against whichever risks seem more costly. For most of the past 2½ years, as inflation soared above 7%, risk management favored a more aggressive approach to prevent inflation from becoming entrenched.

If officials think about which mistake they are less likely to regret at this week’s meeting, the case for starting their rate-cutting cycle with a half-point move makes sense, said Robert Kaplan , who served as Dallas Fed president from 2015 to 2021.

“If I were in my old seat, I’d say, ‘I could live with 25, but I’d prefer 50,’ ” said Kaplan, now vice chairman at Goldman Sachs. Given where inflation and unemployment sit, the Fed’s benchmark rate should be about 1 percentage point lower than it is, he said. “If I started with a clean sheet of paper, I’d say rates should be at 4.5%-ish.”

FILE PHOTO: U.S. Federal Reserve Chair Jerome Powell holds a press conference following a two-day meeting of the Federal Open Market Committee on interest rate policy in Washington, U.S., July 31, 2024. REUTERS/Kevin Mohatt

Because inflation hasn’t been fully defeated, the Fed should avoid a situation where the economy weakens more and forces a faster or deeper series of cuts that risks reigniting inflation, Kaplan said.

Fed officials aren’t likely to regret a larger rate cut this week if the economy chugs along between now and their next meeting, in early November, because rates will still be at a relatively high level, he said. But if the Fed makes a smaller move and the labor market deteriorates more rapidly, officials will feel greater regret.

Minutes from the Fed’s meeting in late July show some officials were comfortable with a cut then but most preferred to wait. July hiring figures, released two days after the Fed’s July 31 meeting, were much softer than anticipated. “The Fed is one meeting too late. It’s manageable, but if they had a do-over, I would have liked to have had a cut in July,” Kaplan said. “I’d rather rectify that now and get on the front foot than to spend the entire fall behind the curve and chasing the economy down.”

What’s next

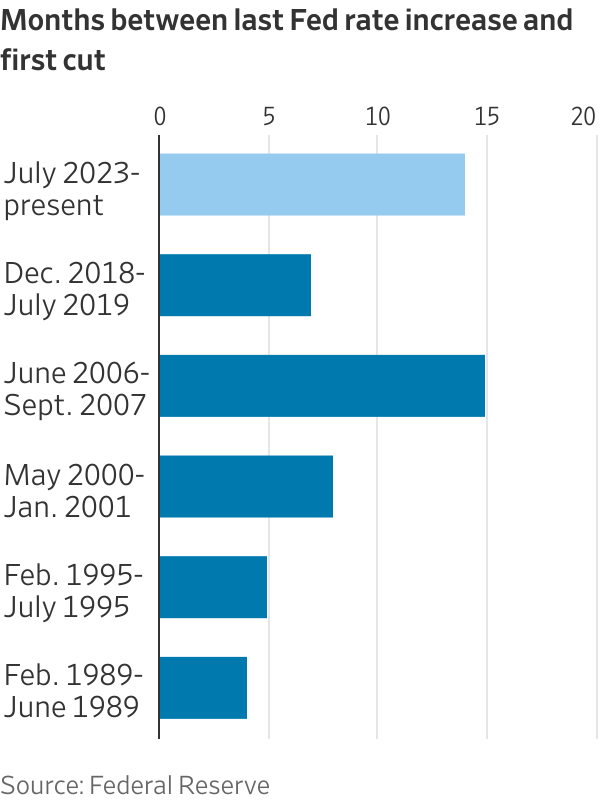

The Fed’s choice will be augmented by quarterly economic projections that show where officials expect rates to end the year. While those forecasts aren’t the product of a committee deliberation, they are often as important to financial markets because policymakers’ rate outlook can influence a suite of borrowing costs for mortgages , car loans and business debt.

The September projections are particularly informative because there are only two more scheduled meetings this year, in November and December, providing unusually specific views on decisions at those meetings.

If more officials project a total of 1 percentage point of cuts this year, that would imply at least one move of 50 basis points this year. Withholding that larger cut until later this year could raise awkward questions over why that is the best approach. Another option is to cut by 25 basis points now and project cuts of a similar magnitude at the last two meetings of the year, reserving the option to accelerate the pace if the economy worsens.

Because the decision this week is a close call, Powell could face at least one dissent on the decision from the 12 policymakers—five reserve-bank presidents and seven Washington-based governors—who vote on policy. No Fed official has voted against a policy decision in two years, matching one of the longest such streaks in the past half century.

Moreover, no Fed governor has dissented on a rate decision since 2005.

That this week’s decision is a close call could reflect honest uncertainty over the right choice, English said. “It’s not like you have half the committee at 50 and half at 25, and they’re shouting at each other. You have a bunch of people who are genuinely uncertain what the right thing to do here is,” he said. “In the end, Powell can probably build a reasonable consensus around either.”

Write to Nick Timiraos at Nick.Timiraos@wsj.com