BEIJING—Boeing’s long-awaited delivery resumption of its 737 MAX jets to China faces fresh delays after the Alaska Airlines incident, asthe plane maker was poised to benefit from the thaw in U.S.-China relations.

China Southern Airlines, one of several Chinese carriers with undelivered MAX jets, has been readying to receive Boeing’s planes as early as January, people familiar with the matter said. Now the airline is planning to conduct additional safety inspections on those aircraft following the incident, the people said, though the jets to be delivered aren’t the same variant as Alaska’s MAX 9.

It couldn’t be determined how long the additional inspections could take, but they add uncertainty to the timing of the deliveries, which have been frozen by Beijing for years since two fatal crashes of the 737 MAX 8.

China’s aviation regulator has also instructed the country’s airlines to conduct precautionary safety inspections on their Boeing 737 MAX fleets, people briefed about the matter said. The MAX 9 isn’t among the fleets of Chinese carriers.

Boeing declined to comment. China Southern and the Civil Aviation Administration of China didn’t respond to requests for comment.

On Monday, Boeing sent a memo to staff saying it was doing additional inspections of its 737 production line and sending additional staff to check the door plugs and other work at Spirit AeroSystems, which supplies the fuselages. Boeing and airlines are still developing a process to inspect the grounded MAX 9 planes so they can return to service.

Resuming deliveries of the 737 MAX jets is a crucial step for Boeing to bring its business back on course in China. The market is set to account for a fifth of the world’s airplane deliveries in the next two decades, Boeing forecasts.

The fuselage plug area of Alaska Airlines Flight 1282 Boeing 737-9 MAX, which was forced to make an emergency landing with a gap in the fuselage, is seen during its investigation by the National Transportation Safety Board (NTSB) in Portland, Oregon, U.S. January 7, 2024. NTSB/Handout via REUTERS. THIS IMAGE HAS BEEN SUPPLIED BY A THIRD PARTY/File Photo

The new delay is the latest blow for Boeing in China after years of grappling with turbulent U.S.-China ties that have caught businesses in the crossfire, as the company worked to regain confidence of Chinese regulators and consumers in its aircraft. Bilateral relations have been reset after President Biden and Chinese leader Xi Jinping met in November, though they remain delicate and it remains to be seen how Beijing will respond to the Taiwan election results.

Beijing is likely to handle the response to the accident carefully to avoid damaging bilateral ties, said David Yu, chairman of Asia Aviation Valuation Advisors. “They don’t want to rock the boat too much,” he said.

So far, China’s aviation regulator has been publicly mum about the Alaska Airlines accident. Beijing is holding off from making further substantive moves as it waits for more clarity from U.S. investigations into the accident, a person familiar with the matter said.

Xie Feng, China’s ambassador to the U.S., recently cited Boeing when talking about steps Beijing has taken to facilitate the exchanges and cooperation between the two countries. In a video speech released on Jan. 9 to commemorate the 45th anniversary of U.S.-China diplomatic ties, Xie said China has supported the return of all Boeing 737 MAX jets to Chinese skies. In January 2023, China brought back the 737 MAX to service after it grounded the jets in 2019.

Boeing-China Relationship

For years, Boeing was the biggest U.S. exporter to China, and aircraft were among the biggest U.S. exports to the country.

Over the past five decades, Boeing has played a key role in helping China establish its commercial aviation industry, from training Chinese aviation officials and pilots to sourcing more components from Chinese suppliers. Boeing also lobbied for China to join the World Trade Organization.

That dynamic changed in recent years as relations between Beijing and Washington spiraled, and China became a source of risk for Boeing.

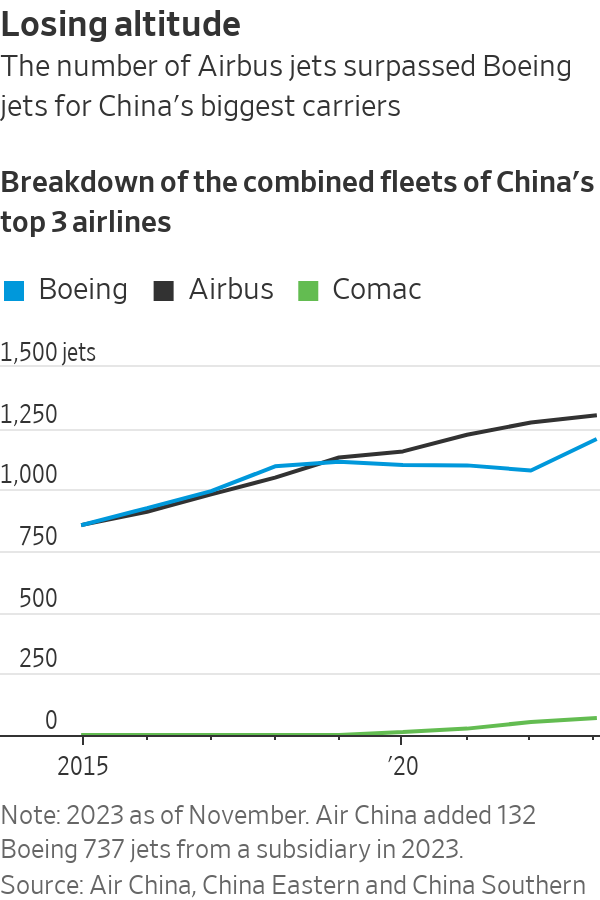

In 2019, China was the firstcountry to ground the 737 MAX 8 following the two accidents, a decision that affected nearly 100 jets its carriers were operating then. That year, the number of Airbus jets among the combined fleets of China’s three biggest airlines surpassed that of Boeing. The American company’s commercial aircraft sales to China slowed to a trickle while Airbus, its European rival, received orders for hundreds of jets.

The issue surrounding Boeing has become politicized in China, said Richard Aboulafia, managing director of AeroDynamic Advisory, an aerospace consulting firm.

Since China returned the 737 MAX to its skies, Boeing has been seeking to resume delivering its backlog of orders to Chinese customers—but Beijing has been slow to grant approval.

Some 85 Boeing 737s were parked waiting for delivery to China as of September, according to Boeing’s latest financial report. Its chief executive, David Calhoun, said in October that Boeing was working closely with Chinese customers on the timing of resuming deliveries.

Boeing and China Southern had discussed resuming deliveries in the third quarter of last year. But the Chinese carrier couldn’t secure Beijing’s approval for importing the jets then, people familiar with the matter said.

Thaw Begins

A turning point was the Biden-Xi summit in November in California, held in an effort to stabilize the turbulent bilateral relations. Weeks later, Mike Fleming, a Boeing executive in charge of the 737’s return to service, met with Civil Aviation Administration of China officials in Beijing. Fleming told them that Boeing remained optimistic about its growth in China, according to a readout by the Chinese regulator.

Shortly after, the regulator informed Boeing that China had approved its delivery, a person familiar with the matter said. Industry publication the Air Current earlier reported on the CAAC approval.

Following the approval, Boeing initially planned to deliver China Southern’s order in December, but that was then pushed back to January, people familiar with the matter said. The aircraft had to be checked by China Southern, as they had been sitting in Boeing’s inventory for years.

In December, some crew members of China Southern arrived in Seattle to test the first 737 MAX 8 jet to be delivered and to prepare to fly it back to China, people familiar with the matter said. Completing the checks had taken longer than earlier expected, people briefed about the matter said.

Then came the Alaska Airlines accident. On Jan. 5, an Alaska-operated 737 MAX 9 made an emergency landing after a section of the aircraft ripped off midair and left a hole in the plane.

Aboulafia of AeroDynamic Advisory said jetliners are among the few levers China can pull in response to the U.S. trade restrictions on exporting semiconductors to China.

The geopolitical element tied to Boeing is “going to be really hard to overcome,” he said.

—Sharon Terlep contributed to this article.

Write to Yoko Kubota at yoko.kubota@wsj.com and Raffaele Huang at raffaele.huang@wsj.com