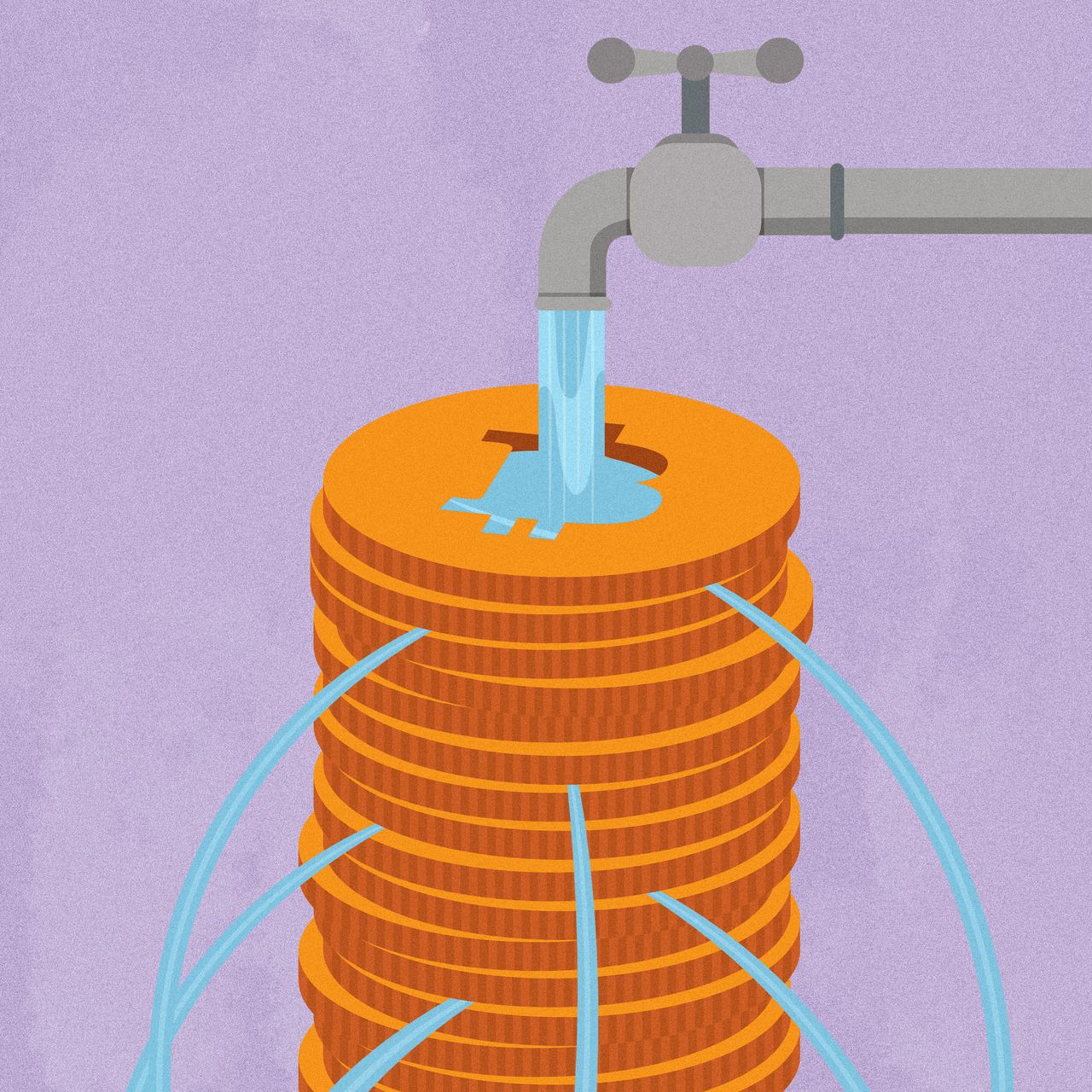

A water hog is lurking in your crypto wallet.

Bitcoin-mining operations slurp up billions of gallons of water globally each year. Estimates vary, but the annual footprint is projected to surpass 591 billion gallons of water this year, according to an article published last weekin the peer-reviewed journal Cell Reports Sustainability.

For comparison, New York City residents and businesses consumed 403 billion gallons in 2022, according to the U.S. Geological Survey.

Miners use water directly to cool their computer servers and indirectly by running both computers and air conditioning systems powered by gas- and coal-fired power plants that require cooling water. Some of the cooling water used by power plants evaporates and is no longer available for anything else.

Bitcoin mining requires massive amounts of energy. During mining, computers generate random numbers in hope of getting the correct one required to unlock fresh bitcoin.

The greater the computing power, the higher the chance that a company or individual running a mining operation can harvest new bitcoins.

The volume of water used to support the mining is an environmental concern, especially in areas that lack freshwater or are at risk of drought.

“We are struggling with water shortages around the world, so having another demand is not something that we would welcome right now,” said Kaveh Madani, director of the United Nations University Institute for Water, Environment and Health in Hamilton, Ontario.

Madani examined the environmental impact of bitcoin mining for the U.N. in a study published in October and found that in 2021, the operations had a global water footprint of 255 billion gallons of water.

Last week’s article in the journal Cell Reports Sustainability found that global bitcoin mining used 415 billion gallons of water in 2021 and 591 billion gallons this year. The author, Alex de Vries, is a doctoral candidate at Vrije Universiteit Amsterdam and founder of Digiconomist, an online platform that tracks environmental impacts of cryptocurrencies.

Madani and de Vries each said getting accurate data about water use is difficult and attributed differences in their estimates to having used different data sources and methods.

The U.N. report relied on data from the International Energy Agency and the University of Cambridge Centre for Alternative Finance. De Vries used the Cambridge data, compiled publicly available data from 34 large-scale bitcoin mining operations in the U.S., and used estimates taken from previous studies of computer-server operations.

In the U.S., bitcoin mining consumes enough water for 300,000 households a year, according to de Vries.

Texas is the bitcoin capital of the U.S., with more than 28% of mining activity, followed by Georgia and New York, according to a September report by Foundry Digital, a New York-based finance and advisory firm.

Finding a solution to quench the water and energy demands of cryptocurrency hasn’t been easy. In 2022, a coalition of environmental groups pressured the bitcoin community to cut its overall use of fossil-fuel generated electricity that requires cooling water, although the results of the effort aren’t yet clear.

Even though the industry continues to grow, it has become 16% more efficient in its energy use from August 2022 to August 2023, according to Perianne Boring, founder and chief executive of the Digital Power Network, an affiliate of the Chamber of Digital Commerce. Most water used by bitcoin-mining operations is recycled or returned to the environment, Boring said.

“Bitcoin miners, like any other industry, have a legitimate right to use water resources responsibly,” Boring said. “Critiquing bitcoin mining for its water consumption is akin to criticizing homeowners for flushing toilets.”

Bitcoin could change its software to require fewer calculations to mine its currency, significantly reducing its need for both electricity and cooling water, according to Paolo Natali, principal at the Rocky Mountain Institute,a nonprofit environmental research and consulting organization. But since bitcoin isn’t owned by a single company, that change would require nearly all of the parties involved in its maintenance to agree on a change.

Changing the way bitcoin is mined “is a bit unwieldy and unworkable because it will require some consensus among all the holders of bitcoin, or for them to start trading different currencies,” Natali said.

Write to Eric Niiler at eric.niiler@wsj.com