While Federal Reserve officials aren’t likely to change interest rates in the coming week, their meeting will nonetheless be one of the most consequential in a while.

At each of their four meetings this year, interest-rate cuts have been a question for later. This time, though, inflation and labor-market developments should allow officials to signal a cut is very possible at their next meeting, in September.

As a result, the coming week’s meeting, which wraps up Wednesday, could resolve the trade-off Chair Jerome Powell has been weighing between the risks of cutting rates too soon and waiting too long, in favor of acting sooner.

One reason officials aren’t likely to deliver a cut this time despite the growing case for one is that it would likely be the first reduction in a sequence to recalibrate rates lower. Officials have been surprised by inflation in the past and want more evidence it is truly cooling before crossing the rate-cut threshold.

Nonetheless, officials have grown more wary of waiting too long and blowing a soft landing. Bringing inflation down to the Fed’s 2% goal while maintaining a healthy labor market “is the No. 1 thing that just does keep me awake at night,” Powell told lawmakers this month .

In a recent interview, New York Fed President John Williams signaled that a July reduction wasn’t warranted , saying officials would “learn a lot between July and September” and pointing to solid economic activity recently. But he added that “there is a decision ahead of us at some point to decide” how to “lower interest rates in a way that lessens how restrictive policy is.”

The Fed’s newfound readiness to cut rates reflects three factors: better news on inflation, signs that labor markets are cooling and a changing calculus of the dueling risks of allowing inflation to remain too high and of causing unnecessary economic weakness.

Inflation progress resumes

A measure of underlying inflation that excludes food and energy prices fell to 2.6% in June from 4.3% one year earlier and a peak of 5.6% two years ago. Williams said the decline has been broad based and dismissed concerns that bringing it all the way back to the Fed’s 2% goal would be unusually hard.

“It is not really a story about a ‘last mile’ or some part that’s particularly sticky,” said Williams. Different inflation measures are “all moving in the right direction and doing that pretty consistently.”

Inflation fell last year even though the economy grew solidly because labor- and product-market bottlenecks eased. Powell has repeatedly warned that because price measures lag behind changes in economic conditions, waiting until inflation hits 2% to cut rates means “you’ve probably waited too long.”

A cooler labor market

The unemployment rate has climbed this year to 4.1% in June from 3.7% at the end of last year, largely because hiring has slowed and it is taking new workers or those re-entering the workforce longer to find work. That limits workers’ ability to seek hefty wage gains that might sustain higher inflation.

Powell’s observation recently that the labor market is “not a source of broad inflationary pressures” suggests a major source of anxiety about the potential for an inflation flare-up has receded.

Two years ago, Fed officials argued the labor market was so unbalanced that companies might respond to higher rates and weaker demand by culling job vacancies rather than laying off employees. So far, that is what has transpired.

“Right now, the labor market is in a sweet spot,” said Fed governor Christopher Waller , one of the most vocal advocates of that thesis, in a recent speech. “We need to keep the labor market in this sweet spot.”

The same analysis predicted the labor-market cooling would remain painless for only so long, and at some point, the traditional trade-offs between less demand for labor and higher unemployment would return.

“If you’ve actually come this far along what was considered to be a very, very bold and out of consensus trajectory, then yes, you want to stick the landing,” said Richard Clarida , a former Fed vice chair.

Shifting risk-management calculations

With inflation resuming its progress and the labor market cooling, Fed officials face a shift in the trade-offs they often refer to as risk management, which boils down to which problem—somewhat elevated inflation or rising unemployment—they judge as harder to fix.

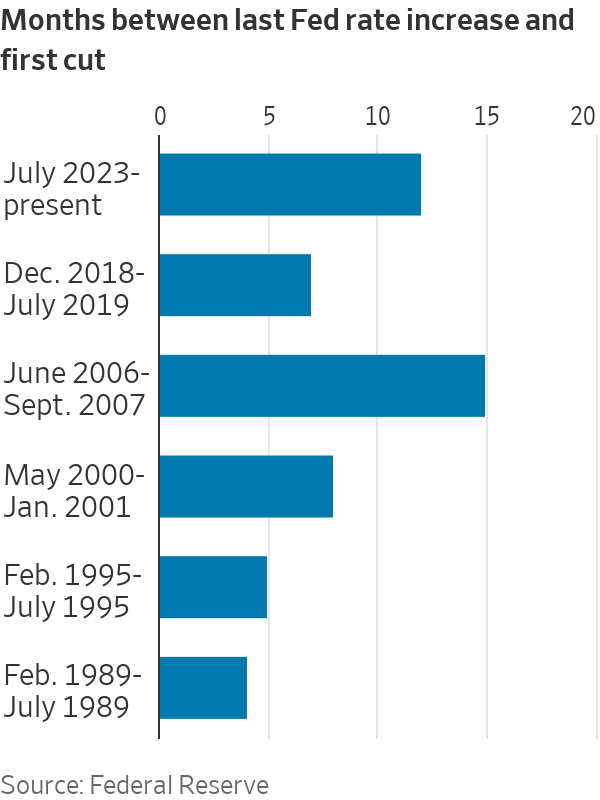

The Fed was late to raise interest rates two years ago in part because it had incorrectly judged inflation would subside rapidly. The Fed was able to correct that mistake, but to do so, had to rapidly raise rates from near zero in 2022 to around 5.3% in July 2023, the highest in more than two decades. One lesson: “When you’re too confident that your view is correct, you’re prone to mistakes,” said San Francisco Fed President Mary Daly .

The Fed doesn’t expect demand or hiring to weaken much in coming months, but if it is wrong, it probably won’t be able to cut rates quickly enough to forestall a recession. “If you’re behind on [cutting rates] when the labor market starts to falter, it’s really challenging to get that back on track. It is just not the same thing” as the belated start to rate increases two years ago, said Daly.

Some officials have previewed arguments they will likely use to persuade their colleagues it is time to cut. “We set this rate when inflation was over 4%, and inflation is now, let’s call it, 2.5%. That implies we have tightened a lot since we’ve been holding at this rate,” Chicago Fed President Austan Goolsbee said in an interview. “You only want to stay this restrictive for as long as you have to, and this doesn’t look like an overheating economy to me.”

Still, more policymakers, including Daly, have indicated they think they can take a little more time, underscoring their high-wire balancing act. Even with better inflation data recently, “we’re not at price stability yet,” Daly said at a conference this month. History warns against “pre-emptive action or urgent action when urgency isn’t required,” she said.

Write to Nick Timiraos at Nick.Timiraos@wsj.com