When Brian Chesky and Joe Gebbia decided to rent out the mattress in the living room of their San Francisco home with breakfast, they probably had no idea they were laying the foundations for a short-let empire.

A range of factors has made Greece a lucrative market for Airbnb, with obvious impacts both positive and negative on local communities. It is indicative of the “fertile climate”—or, put another way, the regulatory void—in Greece that the turnover of the local Airbnb economy is expected to reach 4 billion euros this year. “During the period of rapid growth, property in Greece was beginning to become a burden”, Eva Papatzani, a Social Geographer from the National Technical University of Athens, told To Vima.

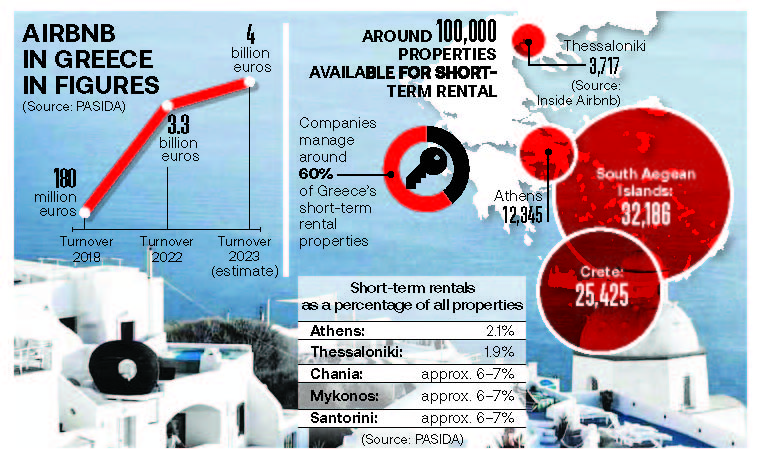

In 2018, when the short-term accommodation register was set up, the Airbnb economy was estimated to be worth 180 million euros. “By 2022, turnover had risen to 3.3 billion euros, while it is expected to reach 4 billion euros this year,” says Andreas Chiou, president of the Greek Property Managers Association (PASIDA), which represents 6,500 owners and management companies.

Airbnb has around 100,000 rooms, apartments and houses on its books around Greece. Downtown Athens alone has 12,345 properties, Thessaloniki 3,717 and Crete 25,425, with the number soaring to 32,186 for the South Aegean Region.

The case of Athens

The expansion of short-term rentals in downtown Athens has been accompanied by fierce debate and fears that rents will skyrocket and the centre lose its identity. “One feature of the city which distinguishes Athens from other European cities is that its functions and activities are all mixed up together. There is no zoning, and the diversity extends to its permanent residents, migrant population and tourists”, Eva Papatzani notes. But, she warns, “This unique character is threatened by the increase in speculative real estate investment.”

The Historic Centre is the area with the most listings on the platform (2,317). In all, 765 entries are registered by users with 1–3 properties, while 1,552 are rented out by individuals or legal entities with 4 or more listings on the platform.

In Koukaki, we find 1,072 Airbnb listings. Of these, 492 of the properties are rented out by individuals with 1–3 listings on the platform, but the remaining 580 belong to users with 4 or more listings, which would imply to companies.

Other areas with high numbers of listings include Exarchia with 928 entries, Neos Kosmos with 911, Metaxourgio and Vathi Square with 794, and the area around Attiki Square and Agios Panteleimon with 561 entries.

The management companies

However, reservations have to be raised about the role played by management companies and their ability to regulate prices in both the short- and long-term leasing market. The President of PASIDA responded thus: “Companies now manage about 60% of the properties on the platforms. However, that does not mean they regulate the real estate market. The market regulates itself through the platform. A short-term rental property will only earn money if it has good ratings. If it is too expensive, visitors won’t choose it. So, we can’t say that rents have increased purely because of short-term rentals. In Athens alone, there are 120,000 empty apartments that could be used in the context of housing policy.”

The islands and extending the tourist season

Airbnb has also found fertile ground on islands like Sifnos and Skopelos, and parts of the Peloponnese such as the Mani, where mass tourism has yet to leave a mark. Turning to the Ministry of Tourism’s stated objective of extending the tourist season and promoting new destinations, Andreas Chiou argues that “These objectives can’t be achieved by hotels alone. A hotel in a summer destination can’t stay open from October to May, because it would lose money if it did”.

“But, seeing as short-term renting has no costs, a house can be made available all year round. And there are apartments available for short-term rentals even in the most remote part of the country,” he adds. Besides, he argues, short-term rentals have not taken clientèle away the hotels, they have created a new clientele: “What’s more, around half of the tourists who visited Greece this summer could not have been accommodated without short-term rentals.”

Put on the brakes or hit the gas?

As the impacts of Airbnb’s rapid growth have begun to leave their mark on the country’s appearance and economy, more and more voices are calling for restrictions on short-term rentals. Article 111 of Law No. 4446/2016 introduced the first legislation regulating the short-term leasing market. The law provided for the imposing of restrictions on Airbnb through the issuing of Joint Ministerial Decisions (JMD) banning users with more than two properties on the platforms and imposing a cap on the number of rental days permitted per year in certain areas. These Decisions were never issued, however.