Revolut announced the launch of its ETF (Exchange-Traded Fund) investment programs, on Thursday, Jan 16, now available across the entire European Economic Area (EEA), including Greece. Investment services in the EEA are provided by Revolut Securities Europe UAB.

By eliminating fees on ETF investment programs, Revolut aims to make investments more accessible to a broader audience, helping to effectively leverage investors’ money.

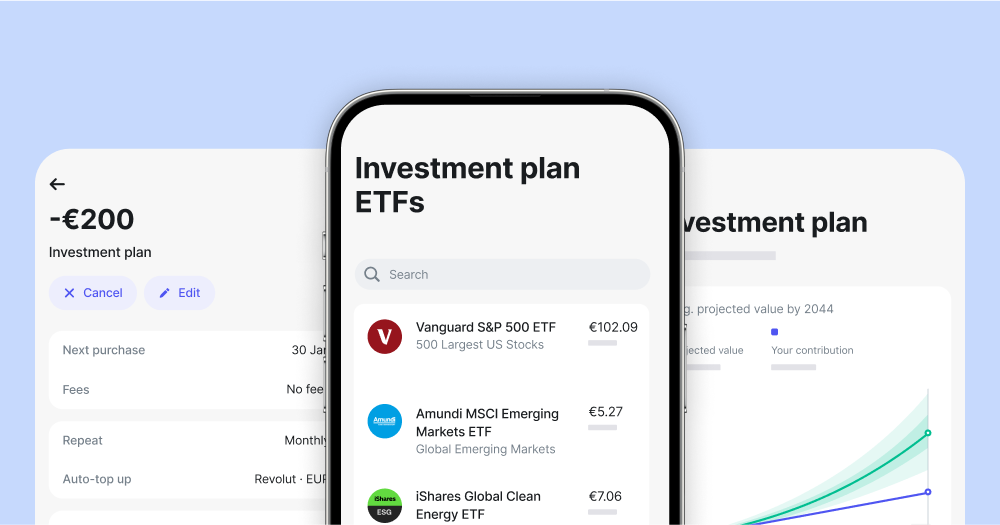

Its customers can set up automatic, recurring contributions, such as weekly, starting from the amount of just 1 euro, to over 300 listed ETFs in the EU (from BlackRock, Vanguard, or Amundi). These transactions will be commission-free and will not count toward the monthly limit of their subscription plan.

According to a survey conducted by Dynata on behalf of Revolut in Greece, 44% of investors said that low and transparent fees are the most important factors when choosing an investment provider.

With Revolut’s commission-free ETF investment programs, all invested funds remain in the investor’s portfolio, allowing for greater compounding and long-term growth.

ETFs are investment funds that track an index or large, diverse collections of securities or commodities, offering instant diversification with a single product.

Revolut offers a wide range of ETFs, catering to various risk tolerance profiles and multiple investment goals, from ETFs focused on bonds to alternative solutions based on stocks.

Regarding ETF investment programs Rolandas Juteika, Head of Trading (EEA), stressed that

“Our investment programs simplify wealth creation by automating your contributions, all without fees. By offering commission-free ETF investment programs, we empower people to make the most of their money and make smarter financial decisions along the way.”