Greek supermarket chains are increasingly turning their attention to the growth potential of minimarkets and smaller-scale retail in Greece.

Major players in the industry, like AB Vassilopoulos, My Market, and Masoutis, are investing in smaller-scale stores within local communities, according to a report by Ta Nea.

Ta Nea highlights that small-scale retailers generated sales of €5.15 billion in 2023, with the market share of these smaller shops steadily rising. In comparison, the turnover for supermarkets during the same period reached €12 billion.

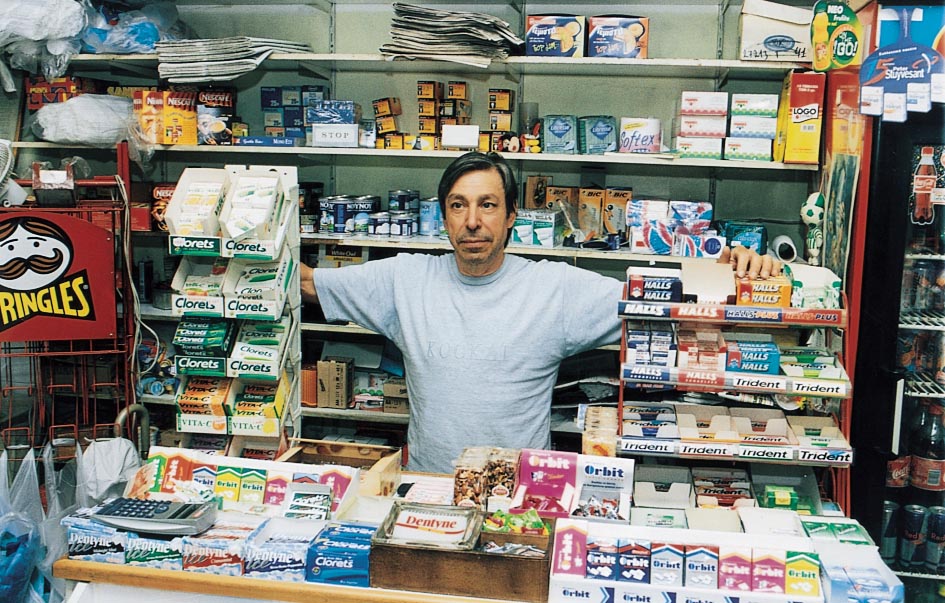

The small-scale retail sector is a loose term that comprises minimarkets, kiosks, corner stores, and other small shops, typically operated as sole proprietorships, which offer a limited range of products.

Covid-19 Changed the Way We Shop

The expansion of this sector is largely driven by increasing consumer demand for convenience and efficiency, particularly in the post-COVID-19 era, as noted in a study by PwC.

The same study also indicates that the rise in remote working trends means consumers are less inclined to drive to large supermarkets, which are often located outside city centers. Instead, they prefer to shop at nearby stores that are easily accessible on foot.

That being said, the concentration of small retail shops is highest in Greece’s most populated cities. The Attica region hosts 22.8% of them, followed by Thessaloniki at 9.1%.

Grocery stores and minimarkets are more widely dispersed, with 21.3% located in Attica and Thessaloniki combined, while kiosks and convenience stores have higher concentrations of 41.4% and 46.8%, respectively, in Attica and Thessaloniki.

Greek Supermaket Chains Bet Big on ‘Small’

Greek supermarket chains have also recognized that Greece’s booming tourism industry and the widespread presence of Airbnb accommodations are driving demand for stores in tourist-heavy areas.

In response to these trends, AB Vassilopoulos is planning a significant investment of around €50 million in franchise development, although it also intends to close 11 company-owned stores, according to Ta Nea.

The well-known minimarket chain OK! has recently expanded its footprint by adding 10 new stores to its portfolio. Similarly, the My Market Local brand is aiming to grow its network further within neighborhoods.

Another emerging trend in Greece is the all-in-one concept that combines a store, café, snack, and wine shop. This trend is exemplified by the Mini STOP kiosk brand, as noted by Ta Nea.

However, the growth in the small retail sector is not without challenges. Ta Nea warns that increasing competition from retail chains poses a threat to traditional sole proprietorships.

“These smaller businesses will need to broaden their offerings to avoid losing market share to larger brands,” says Ta Nea.