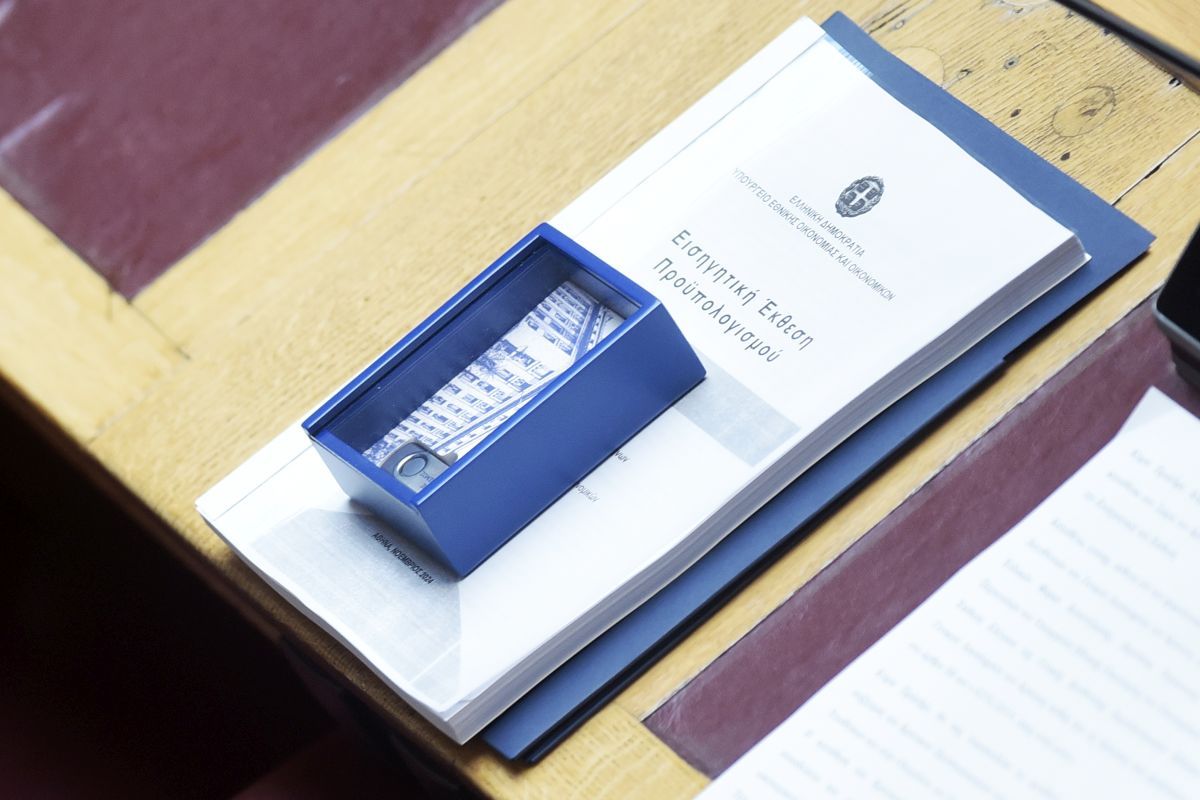

The new Greek budget, submitted to the Parliament on Wednesday, Nov. 20, revealed that the government’s efforts to combat tax evasion have boosted tax revenues in the current budget by 1.8 billion euros, fueling hope for future tax cuts.

In the 2025 budget, there is no specific forecast for revenues from combating tax evasion; however, the observed revenue increase is largely attributed to new digital tools such as the integration of cash registers with POS systems, the rise in electronic transactions and the implementation of the myDATA system, which are generating additional income for the state treasury.

The sentiment is that if the measures continue to be effective, there could be room for further tax reductions, particularly targeting middle-income groups.

According to a senior government official, by September 2025, there will be clear and measurable results regarding the fight against tax evasion. These results will indicate to what extent the additional revenue can fund new initiatives starting in early 2026, with a probability of new tax cuts being announced by the government.

The finance ministry’s economic team anticipates securing an additional 2.5 billion euros in tax revenues by the end of 2026 through anti-tax evasion efforts. Notably, this year’s 1.8 billion euros revenue surplus from tax evasion measures includes 1 billion euros from VAT due to increased electronic transactions and 800 million euros from corporate taxes through the use of myDATA.

The Minister of National Economy and Finance Kostis Hatzidakis has pledged that a portion of the increased revenue from tackling tax evasion will be allocated to further tax cuts.

The government’s plan through 2027 will include adjustments to the personal income tax scale, focusing on rate reductions for incomes between 18,000 and 40,000 euros.

It will also involve further reduction in social security contributions by 0.5 percentage points and a 30% reduction in imputed income thresholds starting in 2026, with the aim of completely abolishing them in subsequent years.