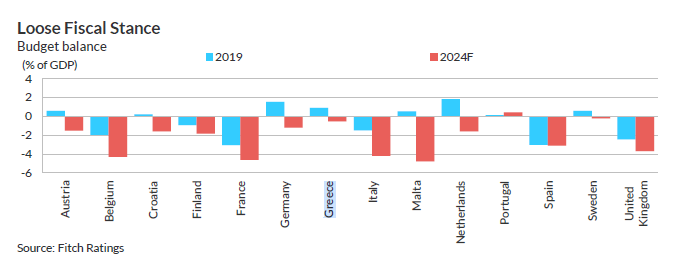

Greece is one of four Eurozone member-states expected to see a reduction in their foreign debt in 2024, according to Fitch. The international ratings agency said the country is forecast to again post a good fiscal performance on the back of consecutive primary budget surpluses.

The other countries in the euro area expected to see reductions in their debt load are Cyprus, Ireland and Portugal. Other EZ members will see foreign debt remaining at the same GDP-to-debt ratio, or increasing. The latter include Belgium, France, Italy and non-EU member Britain.

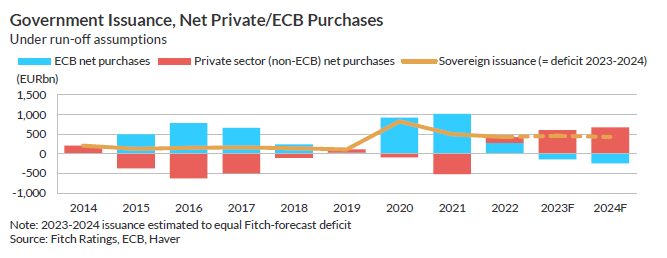

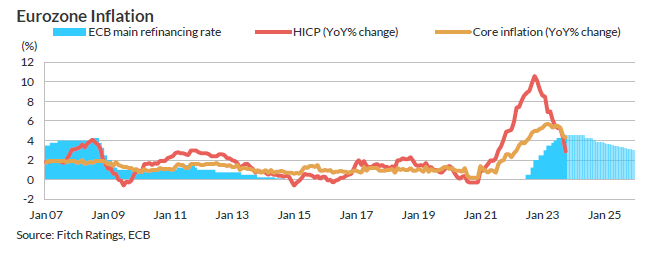

Fitch also estimates that tightening monetary policy by the European Central Bank (ECB), mostly achieved through successive quarterly interest rate hikes, has reached a ceiling.

In its report, Fitch sees the ECB announcing a reduction, by 75 basis points, in rates as of June 2024, and dropping to 3.75 percent by the end of 2024.

The ratings agency, one of the world’s “Big 3”, also forecasts that growth in western Europe will moderately increase next year on the back of a recovery in consumption, something facilitated by easing inflation, a continuing increase in investments and a modest recovery in foreign demand.