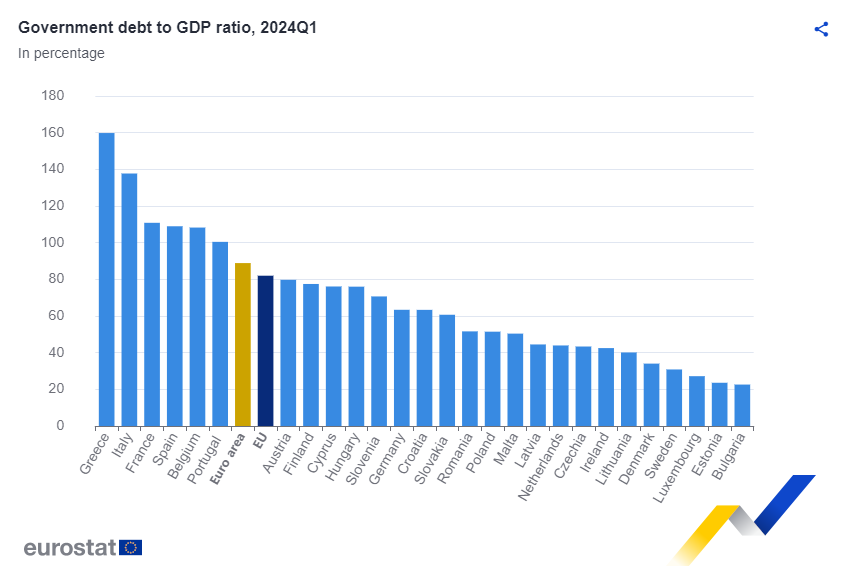

Thrice-bailed out Greece (2010-2018) continues to have the highest debt-to-GDP ratio among Eurozone member-states, although the east Mediterranean country also records the biggest decrease in the specific figure on a three-month basis – and second biggest on an annual basis.

According to data released on Monday by Eurostat, the debt-to-GDP ratio for Greece stood at 159.8% at the end of the first quarter of 2024. The countries that follow are Italy (137.7%), France (110.8%), Spain (108.9%), Belgium (108.2%) and Portugal (100.4%). The lowest ratios were posted by Bulgaria (22.6%), Estonia (23,6%) and Luxembourg (27.2%).

For the entire Eurozone, the figure stood at 88.7%, up from 88.2% at the end of the fourth quarter of 2023. In terms of the entire EU, the debt-to-GDP ratio stood at 82.0% in 1Q, up from 81.5% in 4Q.

Greece has very prominently announced an early repayment of loans totaling eight billion euros, in a bid to underscore the country’s progress in recovering from the debt crisis, as Prime Minister Kyriakos Mitsotakis said during an interview with Bloomberg last month.

The early loan repayments mark the third time that the Greek state accelerated the repayment of a bundle of loans disbursed under the first institutional bailout in 2010.