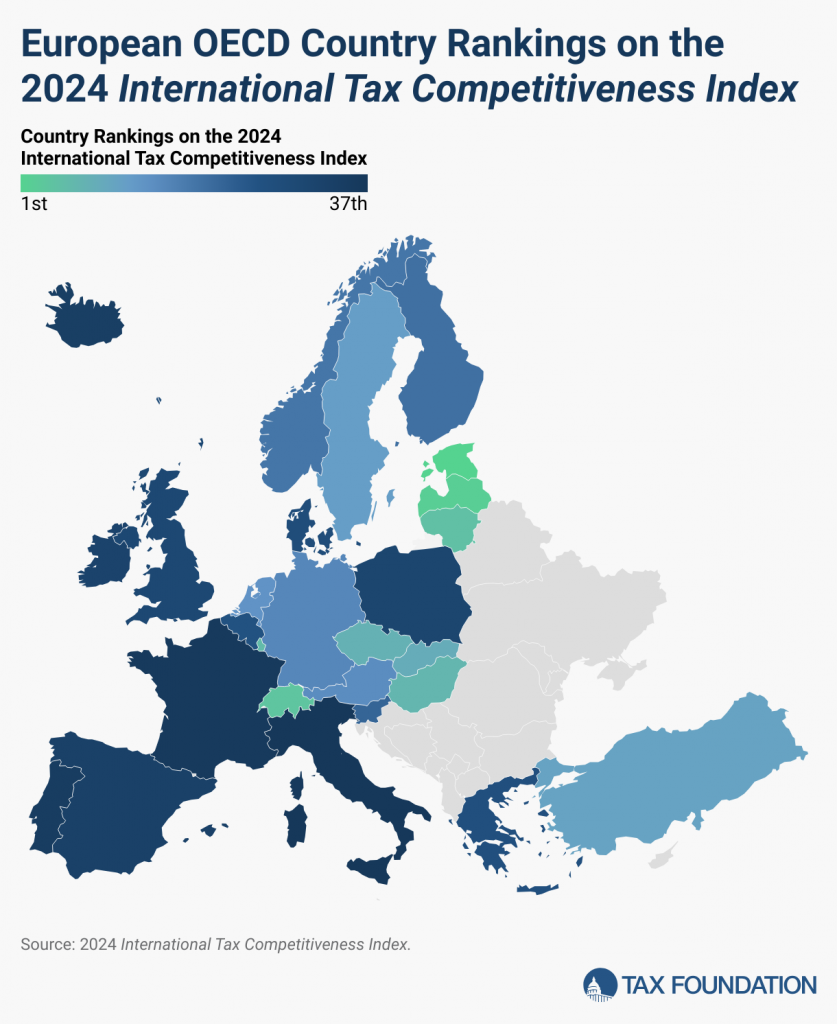

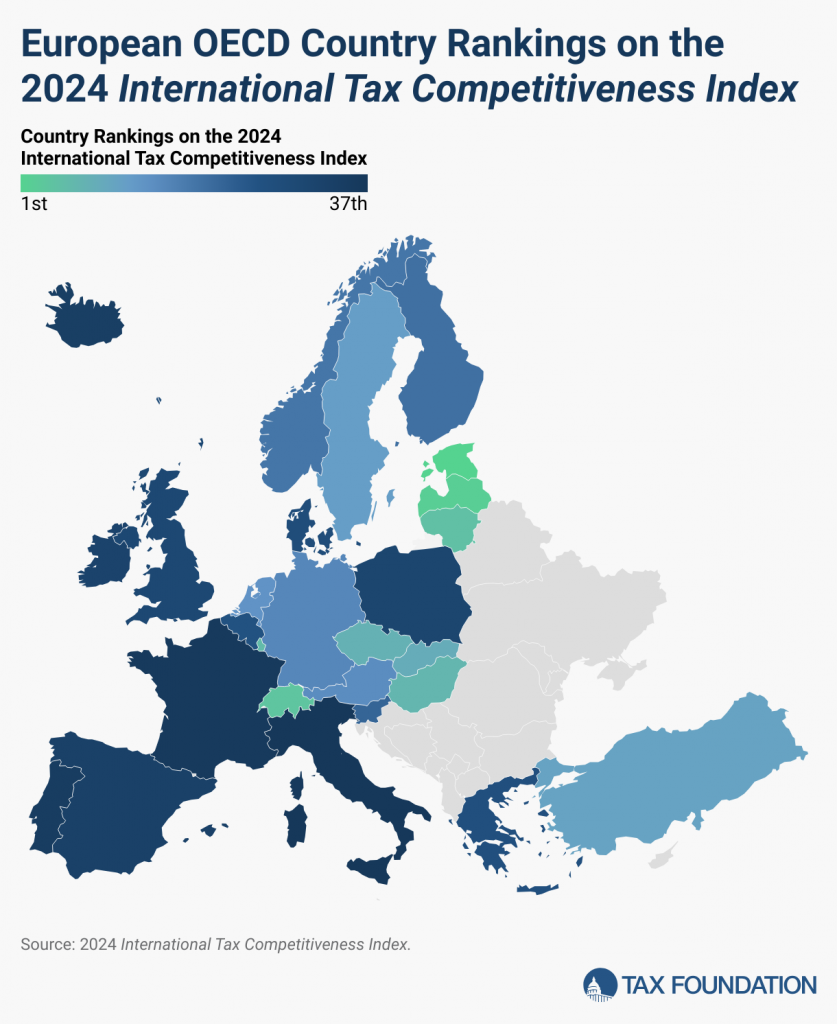

According to the annual report published by the Tax Foundation’s Center of Global Tax Policy, Greece ranks 27th overall out of 38 OECD countries on the 2024 International Tax Competitiveness Index.

The country remained in the same spot from last year’s list and is sandwiched between Belgium (26th) and Denmark (28th). For the 11th year in a row, Estonia ranked 1st on the Index.

The International Tax Competitiveness Index measures how well a country’s tax system promotes sustainable economic growth and investment. The report looks at dozens of variables in five categories: corporate income taxes, individual income taxes, consumption taxes, property taxes, and cross-border tax rules to offer important insight into each OECD country’s tax policy.

According to the report, Greece ranked 17th on the Corporate Tax Ranking, 9th on the Individual Tax ranking, 34th on the Consumption Taxes Ranking 27th on the Property Taxes Ranking and 21st on the Cross-Border Tax Rules Ranking.

The data showed Greek tax system has notable strengths. For instance, the net personal tax rate on dividends is just 5 percent, significantly lower than the OECD average of 24.7 percent. Additionally, Greece’s corporate income tax rate of 22 percent is also below the OECD average of 23.9 percent, making it a more attractive environment for businesses. Furthermore, Greece’s Controlled Foreign Corporation (CFC) rules are relatively modest and only apply to passive income, which provides some flexibility for international business operations.

However, the Greek tax system also has its weaknesses. Companies in Greece face severe limitations in how much net operating losses they can use to offset future profits, and they are unable to apply these losses retroactively to reduce past taxable income. There is also a relatively narrow tax treaty network, with Greece having only 58 treaties compared to the OECD average of 75, which can limit opportunities for international tax cooperation. Finally, Greece imposes a high VAT rate of 24 percent, one of the highest in the OECD, but it is applied to a particularly narrow base, covering only 37 percent of final consumption.