In a move that has drawn sharp criticism from climate advocates, several of the largest U.S. banks, including Goldman Sachs, Wells Fargo, Citi, Bank of America, and Morgan Stanley, have exited the Net-Zero Banking Alliance (NZBA), according to a report by Reuters.

This departure leaves JPMorgan Chase as the sole member of the “Big Six” U.S. banks still in the coalition, which aims to align financial operations with global climate goals.

Pressure to Exit the Net-Zero Banking Alliance

The decision follows mounting pressure from Republican lawmakers who warned that membership in the NZBA could violate antitrust laws, especially if it led to reduced financing for fossil fuel companies.

Meanwhile, incoming U.S. President Donald Trump has explicitly announced plans to reverse President Biden’s renewable energy policies and boost fossil fuel support.

While the banks have avoided directly citing ‘political pressure’ as their reason for withdrawal, critics fear this shift signals a weakening commitment to climate action.

Patrick McCully, a senior energy transition analyst at Reclaim Finance, expressed concern that the banks might reduce their climate commitments in the absence of NZBA oversight. “The key thing to watch will be the weakening of existing targets and policies,” McCully said, though he does not expect banks to publicly announce such changes.

A Blow to Global Climate Goals

The NZBA, which was launched as part of the United Nations’ Race to Zero campaign, still includes 142 members from 44 countries, with European banks like HSBC, Barclays, and BNP Paribas making up the largest share of the coalition’s assets. However, Jeanne Martin, who leads the banking program at the advocacy group ShareAction, criticized the U.S. banks’ departure as a sign that climate change is “less of a priority” for these financial giants.

“This is concerning when they are among the world’s largest providers of financing to fossil fuels,” Martin told Reuters.

Backdrop of Political and Economic Pressures

The exits coincide with a broader backlash against environmental, social, and governance (ESG) investing in the U.S., particularly following a Republican victory in the November elections and the return of Donald Trump to the presidency. Republican officials have accused financial institutions of potentially breaching antitrust rules by coordinating climate-related policies.

Adding to the controversy, a study from 2024, Banking on Climate Chaos, found that the six largest U.S. banks ranked among the top 20 global financiers of fossil fuel companies, explains Reuters.

An analysis by the Anthropocene Fixed Income Institute showed that these banks earned more from fossil fuel financing than from green energy investments.

Net Zero-Banking Alliance Signals Uncertain Future for Climate Finance

Despite their departure from the NZBA, the banks have reiterated their commitment to supporting clients in transitioning to a low-carbon economy. Mindy Lubber, CEO of the non-profit Ceres, emphasized that investors would continue pushing for transparency and accountability.

“Banks are key to supporting the global goal of net-zero emissions and the economic opportunities arising from the transition,” Lubber said to Reuters.

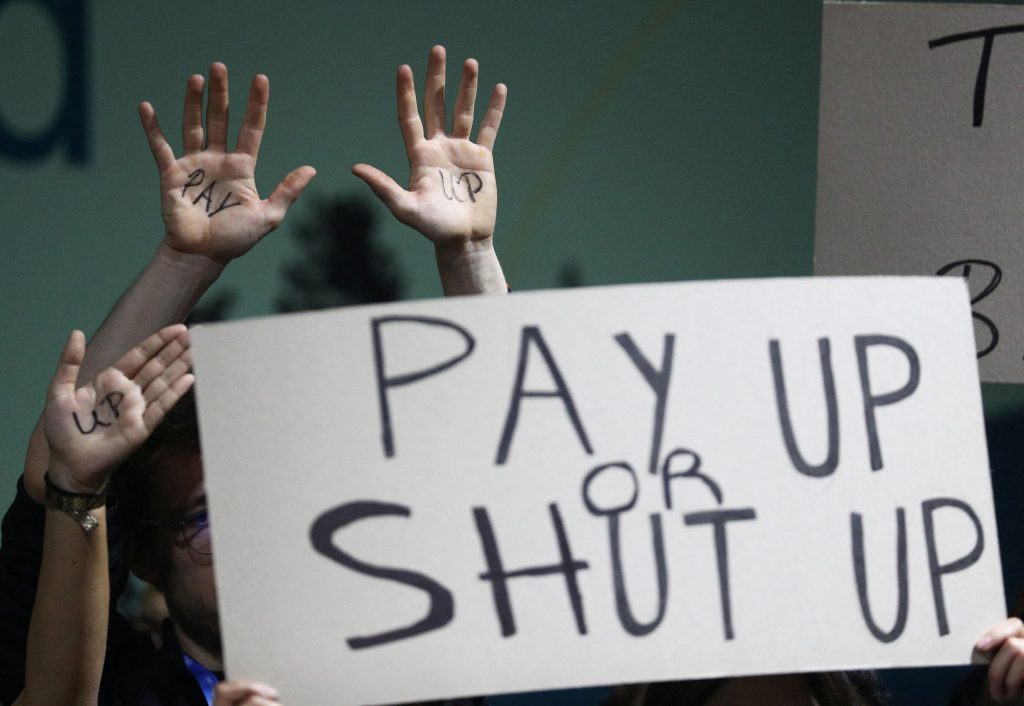

Activists hold a protest during the COP29 United Nations climate change conference, in Baku, Azerbaijan November 23, 2024. REUTERS/Aziz Karimov

Meanwhile, European banks within the NZBA now face an opportunity to take more ambitious climate action without U.S. opposition potentially holding back stricter guidelines. “It’s time for the Europeans to step up and show leadership,” McCully noted on LinkedIn.

The NZBA declined to comment to Reuters on the recent developments.